Letter to investors – 4th quarter 2020

Dear shareholders,

We reached the end of 2020 with a euphoric market, testing maximums in almost all risk assets globally, even in an environment with new activity restrictions, a reflection of the worsening of the pandemic. This movement can be explained by the outcome of the American elections and the prospect of a viable and effective vaccine in the short term.

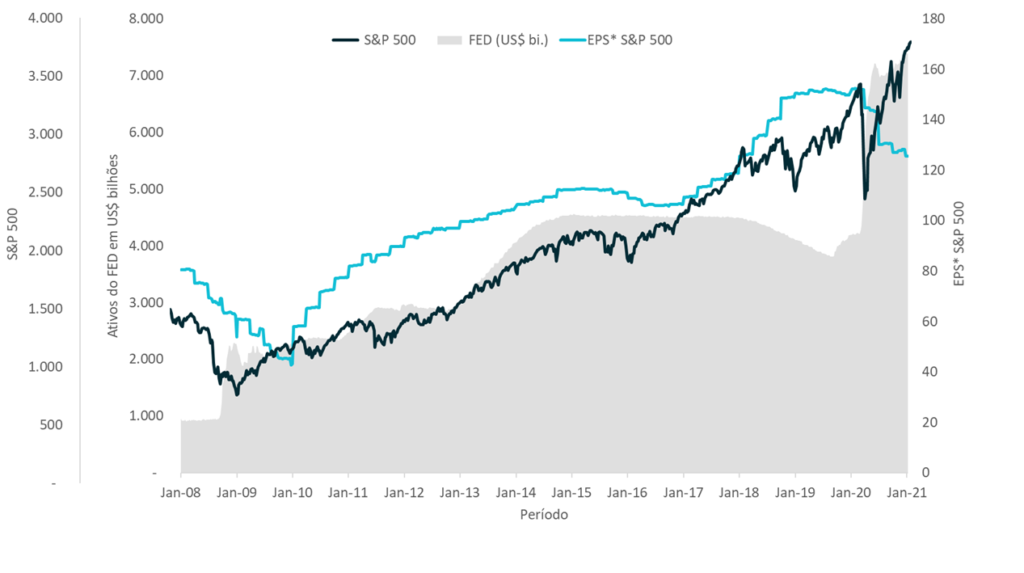

It is important that we try to understand the reason for this behavior. We have repeatedly mentioned the role that central banks play in the markets and how strong the action of the FED (US central bank) was at the height of the pandemic. Although we have not yet identified price inflation on goods and services, assets such as stocks, real estate, commodities and cryptocurrencies have been rising steadily.

Therefore, it is very important to understand that the nature of the market rally is much more associated with the actions of central banks (and governments) than with short-term economic and financial performance. The S&P500, for example, was up 16.6%, while profits were down 17.5% last year.

* EPS (Earnings per Share) – Earnings per share

Over the past few years, we have seen low interest rates, reduced inflation and growing government debt. A period when the United States attracted capital and its currency appreciated against almost all others in the world. The latest events, such as the pandemic and the election, may have broken this long-term cycle, and so we could see a movement of rising interest rates and, finally, inflation. Such a change of regime would directly impact this dichotomy of value companies versus growth.

Simplifying the discussion, high-growth companies with little, if any, cash/earnings generation outperformed those already established and large (but stable) cash generators in recent years. Part of this movement is due to a mathematical macroeconomic issue: the cost of capital. That is, the lower this cost, the higher the value assigned to the future cash generation in relation to current earnings. The feeling that interest rates would stay at low levels forever led companies categorized as growth for an appreciation never seen before. Companies that have little growth, but substantial cash generation, have historically high discounts due to the threat of competition (something disruptive) or simply due to the lack of relative growth.

Therefore, a reversal in the discount rate, which over the last few years has shown a permanent decline, may have a relevant effect on stock returns, and especially in companies that show greater growth, since future cash generation will have a smaller present value.

Thus, prices at historical highs significantly increase risk, since the current rate of return is lower than that observed in the recent past, without a major change in growth expectations.

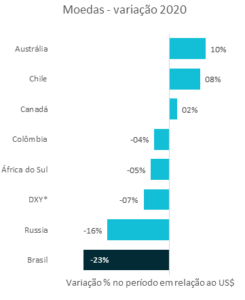

In Brazil, although the Ibovespa had a positive nominal variation in the year (+2.9%), there was a significant destruction of relative value – the Bovespa index was one of the worst performances in dollars in 2020. Our currency was one of the most popular. devalued throughout the year (22.6%), even with the US currency depreciating approximately 7% against a basket of developed country currencies (DXY).

* DXY – index of the value of the US dollar against a basket of developed country currencies;

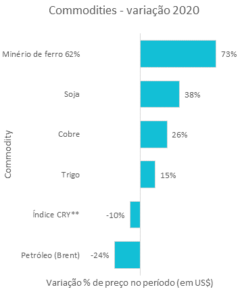

** CRB Index – commodity futures price index

We commented in the previous letter on the topic “rotation” (migration of investors from companies from growth to value sectors) could benefit Brazil, given the predominance of banks and commodity producers in the composition of the index. This move may be a more long-term structural change.

Here, it is worth commenting on the performance of commodities and their relationship with domestic assets. Asian countries, which are showing faster recovery, accelerated their economies with incentives, and thus boosted the demand for raw materials globally. This factor, added to the devaluation of the real, placed Brazil in a rare situation of undervalued exchange and rising/recovering commodity prices. Such a combination is difficult to sustain in the medium term.

We cannot forget Brazil’s fragile fiscal condition, which also explains the country’s poor performance in relation to the world. This coming year will be decisive for the maintenance of the long-term fiscal pillar. Thus, taking advantage of the global liquidity window, if the country moves forward in the reform agenda, even if timidly, could be decisive for us to have an outstanding performance, even if the external environment proves to be challenging.

There is still considerable doubt about the behavior of the economy after the end of emergency aid and a considerable amount of political uncertainty. However, we still see the market discounting an already pessimistic scenario. On the other hand, job creation is very resilient and the fiscal result, despite being very negative, is on the way to being better than expected.

One of our big fears is that the window of cheap financing and stimulus may be nearing its end, contrasting with assets that still depend on this dynamic to sustain themselves. In 2020, central banks acted decisively and swiftly to tackle the pandemic. This effort will have to be processed by the market over the next few years.

From a financial standpoint, the world is much riskier. Markets are at peaks and opportunities, which were once plentiful, have become scarce. Although Brazil has not fully benefited from the global recovery, and there are assets at attractive prices, we do not see the same asymmetry as before. The good opportunities we see are much more specific compared to last year’s alternatives.

Even with the possible advance of major reforms, we do not have significant additional room for a contraction in the cost of capital. So the return will predominantly be profit growth.

A great 2021!

Graciously,

Moat Capital