Dear shareholders,

As we closed the final quarter of 2023, we witnessed a surge of optimism, contrasting sharply with the cautious mood of the previous quarter. The year was marked by shifting expectations and significant fluctuations in asset prices. Notably, U.S. long-term interest rates, specifically 10 Years Treasury, varied between 3.4% and 5% over the year, ultimately returning to their starting point by year-end.

Commodities, particularly in recent times, have underperformed. This is largely attributed to China’s slower-than-expected growth and the limited impact of its stimulus measures, a critical factor in global demand, coupled with a general slowdown in the world economy. Oil prices, despite geopolitical tensions, retreated from their annual highs, lacking sustained momentum. However, iron ore was an outlier, maintaining near-peak prices, bolstered by expectations of China’s economic stimulus initiatives.

The global decrease in inflation during the last quarter led to significant adjustments in interest rates, sparking renewed demand for riskier assets. This change drove stock markets in the U.S. and Brazil towards their highest levels, as the anticipated U.S. recession did not occur.

Despite a gradual slowdown in the U.S. economy, we foresee the reduction of fiscal stimulus as a key factor in the future. The current market optimism, reflecting an overly positive global outlook, make the stock market’s risk-reward balance less appealing.

This optimism is partly fueled by expected improvements in labor productivity, likely due to the increasing integration of Artificial Intelligence in various products and services. Furthermore, immigration is contributing to filling job vacancies, maintaining low unemployment rates, and reducing the pressure for significant wage increases.

Looking ahead to 2024, we see two main themes that could shape market directions: first, whether the global economy can avoid a recession and maintain growth above the global average, supporting higher valuations; and second, how much the end of the interest rate hike cycle is already reflected in market prices.

In Brazil, the recent improvement in inflation, along with a decrease in U.S. Treasury rates, has created a positive environment in the last quarter. Lower interest rates, combined with a revival in the credit cycle, are expected to support economic growth, despite a less optimistic outlook for the agricultural sector due to challenges from the onset of El Niño after three years of exceptional performance.

A significant risk for the Brazilian market is fiscal mismanagement. However, we believe this concern is mitigated by increased government revenues from recent legislative actions. Nonetheless, the potential impact of higher corporate taxes on consumer prices and growth requires careful monitoring.

Another positive development in Brazil is the revitalization of the credit cycle. Financial institutions are poised to increase lending, supported by falling interest rates, strong employment figures, lower default rates, and inflation under control.

The political changes in Argentina also deserve attention, with potential benefits from lower trade barriers and currency adjustments. Successful economic policies in Argentina could positively influence Brazil, its main trading partner.

Globally, 2024 looks promising for emerging markets. A decline in U.S. interest rates, whether due to reduced inflation or economic activity, along with a significant fiscal deficit, might weaken the dollar against other currencies. This situation, combined with a closing gap between U.S. economic growth and that of other countries, is expected to direct substantial capital flows into emerging markets, with Brazil in a strong position.

While we enter the new year with enthusiasm, we advise caution, as U.S. stock prices require a highly favorable environment to continue rising. There is a notable disparity in valuations, with major tech companies at historically high levels compared to the broader market.

In Brazil, the market still shows significant undervaluation. The recent asset appreciation is largely due to a reduced risk premium following the elections. In 2024, Brazil may benefit from a more favorable international environment, especially with the decline in U.S. interest rates and the start of a local credit cycle. However, we must be mindful of our vulnerability to external shocks, such as a recession or geopolitical events, given our political and fiscal uncertainties.

Best Regards,

Moat Capital

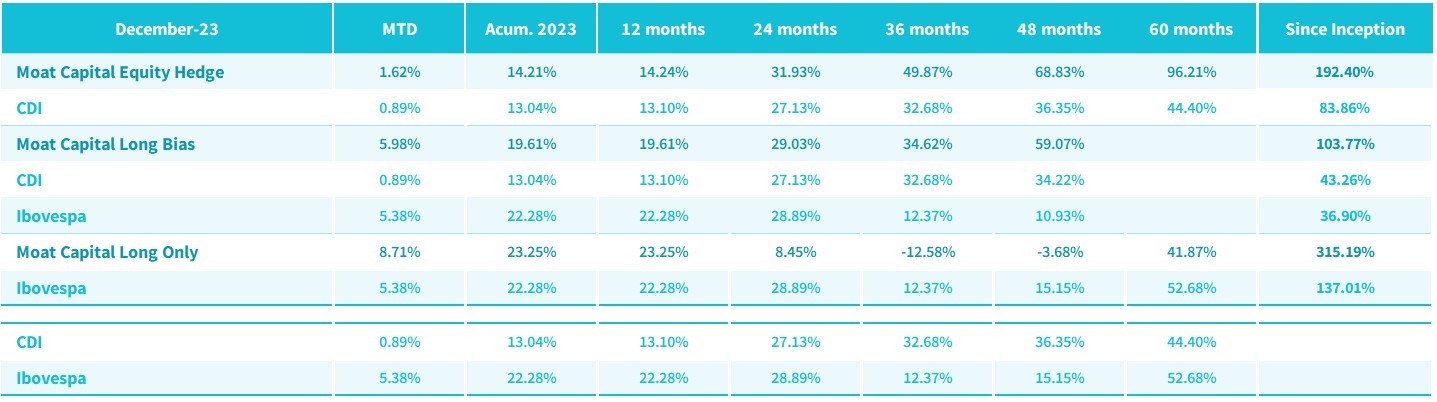

Gross of fees return:

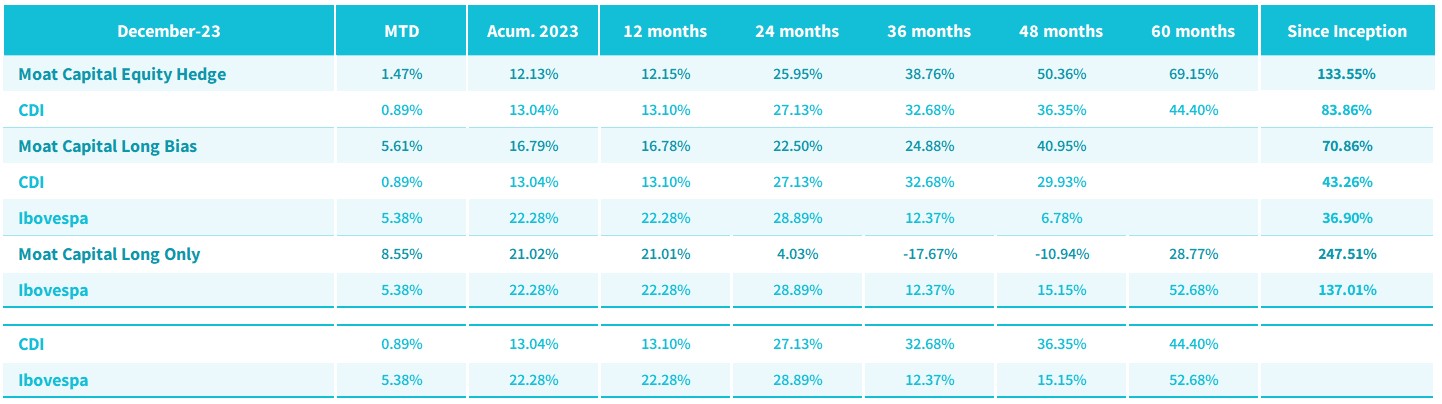

Net of fees return:

Past performance does not guarantee future results. Investments in funds are not guaranteed by the administrator or by any insurance mechanism or, still, by the credit guarantee fund. For more information visit the website www.moat.com.br. The fund performances are net of fees, Standard fees are 2% management fee and 20% over the benchmark performance fee