Dear investors,

The year 2022 was characterized by a series of significant events that solidified the shift in the global economic cycle following years of abundant liquidity and extremely low interest rates. Domestically, we witnessed a sudden shift in expectations, and the anticipated and awaited interest rate reduction was virtually dismissed by the market, delaying the pricing of the start of monetary easing. The global monetary tightening is expected to continue throughout 2023, accompanied by an economic slowdown.

The United States is in an advanced stage of the cycle and are nearing the end of the interest rate hikes. Although the panic over inflation is beginning to subside, the era of low interest rates and high growth is behind us. Investors are anticipating a mild recession given the resilience of the labor market and high domestic savings. However, we are concerned that the ongoing liquidity squeeze by central banks and the impact of higher interest rates may lead to a more rapid slowdown. If previously, negative growth data boosted prices, as it was interpreted that there would be less monetary tightening, the reaction is now different, as investors are wary of a deeper slowdown in activity. This environment could lead to further revisions in the profit expectations of American companies, which makes us view this asset class with negative asymmetry.

In China, with the reversal of Covid control policies, it is expected that the economy will pick up again. Along with the reopening, the government has implemented monetary and regulatory measures to stimulate activity. Stock prices and some commodities reacted in advance to these events, and we have yet to see the expected recovery in numbers. However, it should be noted that China is one of the main trading partners of the Western world, so it should not be completely insulated from a global slowdown.

The factors that contributed to an environment of growth with controlled inflation in recent decades, such as technological advancement, globalization, and abundant energy at a low cost, are no longer present. The Russia-Ukraine War and the competitive environment between China and the US have interrupted two of these three major factors.

In this context, we see Brazil well positioned, as we have a generous and expanding energy matrix at competitive prices. We are the main producer of various agricultural commodities and geographically we are far from major geopolitical conflicts. Therefore, we have great opportunities for development if we can address our internal challenges.

We observed a very strong reaction from the markets to the signals from the elected government about the conduct, and lack of clarity, of the country’s economic policy, evidenced in the behavior of assets, mainly in relative terms with the world. If the negative signals were not enough, the perception of economic agents that Congress would not be able to stop heterodox measures, which we disagree with, generated additional pressure on prices.

The Brazilian stock market was naturally hostage to this environment. Companies linked to domestic activity, sensitive to the interest rate curve, were strongly impacted due to the prospect of prolonging the period of high interest rates, as well as due to the prospect of economic slowdown, already perceived in the last quarter of the year.

However, despite the voluntarism of the new government, full of ideas antagonistic to the last administration, we need to separate the discourse from what is feasible. It is important to understand that the politician has a different timing from the financial agent. No matter how bad the signals and news have been so far, we understand that there is a low probability of backtracking on important structural reforms, such as pension reform, labor reform, or central bank independence.

Tax reform is an extremely important issue both in the macro aspect, due to revenue, and in the micro, due to the impact on companies. It seems ready to be debated in 2023 despite the difficulty arising from the number of interest groups and the complexity of the current model. There are already advances in the discussion on topics such as the end of interest on own capital and the taxation of dividends. We ended last year with a very satisfactory picture of the economy, growth close to 3%, decelerating inflation and a primary surplus of around 1% of GDP. That is, the carry is positive and the reversal of this picture was priced and perpetuated by the market.

Currently, Brazilian stocks, apart from global cyclicals given the commodity cycle, trade at significant discounts on their historical multiples, already considering the strong increase in the cost of capital and a downward revision in profit estimates. Prices signal a scenario where there will be no interest rate cut or real profit growth, which seems unlikely to us even in the face of an uncertain scenario.

Another point that we interpret with more optimism refers to the high level of real interest in Brazil. If on the one hand it raises the cost of capital, making the life of companies more difficult, on the other, it anchors the exchange rate and helps to control inflation expectations, giving conditions for interest rate cuts ahead if there is no fiscal disarray.

In the last letter we saw that the risk asymmetry was not so favorable and even so we suffered losses much higher than we imagined. Despite the worsening of the macroeconomic scenario, we understand that prices suggest an environment of complete dysfunction of the economy which does not seem reasonable to us. We cannot also ignore the global cycle, which with the growth in the price of some commodities, can be decisive in the behavior of domestic markets.

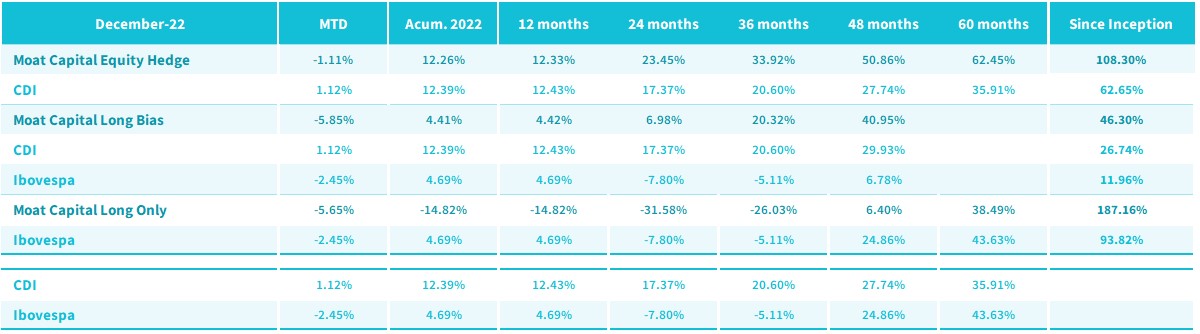

Past performance does not guarantee future results. Investments in funds are not guaranteed by the administrator or by any insurance mechanism or, still, by the credit guarantee fund. For more information visit the website www.moat.com.br. The fund performances are net of fees, Standard fees are 2% management fee and 20% over the benchmark performance fee

Best regards,

Moat Capital