Dear Shareholders,

The first quarter of 2023 was characterized by challenging conditions both domestically in Brazil and internationally. Persistent fiscal uncertainty in Brazil was compounded by the revelation of a significant fraud case at Lojas Americanas, which had a considerable impact on the country’s credit market. This incident further strained an already fragile corporate financing landscape.

The Brazilian government has now unveiled its fiscal policy proposal, aiming to eliminate the public deficit by 2024. The plan primarily focuses on revenue augmentation, underscoring the country’s need for economic growth, while placing less emphasis on expenditure. Despite assurances of no new taxes or rate hikes, indications suggest that we may see measures in this direction, considering the short-term objective of raising an additional R$ 150 billion. Such measures could potentially affect certain sectors of the stock market.

While the proposal may not be ideal, it has been sufficient to reduce the risk premium in the interest rate market and strengthen the Brazilian Real, as it alleviated concerns of fiscal instability over the next four years. However, the stock market, particularly companies closely tied to the domestic cycle and sensitive to interest rates, continues to face significant pressure.

The fund industry is experiencing a high volume of redemptions, exerting additional pressure on local assets. Uncertainties about the trajectory of economic policy, coupled with a high-interest rate environment, have led investors to adopt an extremely conservative stance. Despite the less than optimistic outlook, we believe we are nearing the start of an interest rate reduction cycle, which could serve as a significant catalyst for the stock market. The intensity of this movement will depend on the management of public accounts. Nonetheless, the end of monetary tightening in the U.S. could ease the upward pressure on the U.S. dollar, benefiting the Real and aiding the efforts of the local Central Bank.

Internationally, the year began with significant market volatility. After a positive start for risk assets, the bankruptcy of Silicon Valley Bank and UBS’s acquisition of Credit Suisse have raised serious concerns about the health of the financial sector and the implications for financing conditions. These concerns have been reflected in the U.S. yield curve, signaling a potential recession, a sentiment not mirrored by the stock market, which maintains its profit projections, a discrepancy we find concerning.

In this context, discussions about inflation are giving way to debates about the pace of the U.S. economic slowdown and whether the observed intensity would prompt the Federal Reserve to initiate an interest rate cut cycle this year. Regardless, 2023 is likely to be marked by the end of monetary tightening in the U.S.

Another significant factor that could further complicate global economic recovery is geopolitical issues, such as the war in Ukraine and escalating tensions between China and the United States. Many American companies are redirecting investments to other regions of the world, a phenomenon known as “reshoring” – repositioning production closer to consumption sites after a long period of transferring production to countries with more competitive costs. In this context, it’s challenging to foresee a sustainable long-term impact on commodities from China’s reopening.

Historically, in every U.S. recession, the ideal time to buy stocks has always been at the onset of the recessionary period. This is because the market anticipates and prices in these events, and during a recession, assets are more influenced by expectations of interest rate cuts and monetary easing than by economic activity itself. The situation in Brazil is similar: the market prices in a recession in advance, and when it materializes, assets begin a new upward cycle, even if the economic fundamentals are not yet fully adjusted.

Many companies listed on the stock exchange are currently trading at significantly discounted levels, already incorporating a substantial downward revision of profits. In many cases, this suggests no profit growth at all and an indefinitely high cost of capital. Thus, we believe we are facing a positive asymmetry for the stock market, with the risk being a prolonged environment of high interest rates if the government fails to adequately address the fiscal issue.

The end of the global inflationary cycle should lead central banks to conclude their monetary tightening, which could initiate a favorable cycle for risk assets, despite extremely negative expectations.

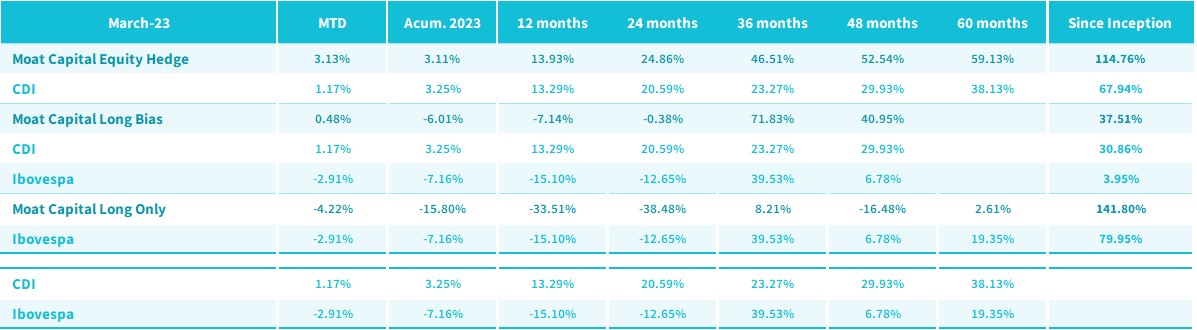

Please note that past performance does not guarantee future results. Investments in funds are not guaranteed by the administrator or any insurance mechanism, or even by the credit guarantee fund. For more information, please visit www.moat.com.br. The fund performances are net of fees, Standard fees are 2% management fee and 20% over the benchmark performance fee

Best regards,

Moat Capital