Letter to investors – 2nd quarter 2019

Dear shareholders,

The second quarter of the year ended in a mood of optimism with global equity markets at historic highs. The big highlight in the period was the change of the FED (American central bank), starting to adopt a dovish discourse (interest reduction) after 18 months of apprehension about the risk of a monetary tightening, which directly affected emerging markets and specifically , Brazil during the electoral period.

Currently, the debate is no longer whether interest rates will be cut in the US, but the intensity of the monetary easing. It is also important to point out that it is the first time in history that the FED changes the interest rate trajectory without a significant reduction in activity. This posture is attributed to the external risk of a slowdown in global economic activity.

Nevertheless, we observe conflicting data from the American economy, that is, a reduction in the growth rate, but there is still no concrete sign of an upcoming recession. China, on the other hand, shows clearer signs of deceleration. However, the central government still has great power to stimulate the local economy and prices.

The world went through a disinflationary wave, the result of a great gain in productivity and improvement of global chains (example: trade agreements between regions). Despite news in the media about the trade war, global trade continues to grow and there are other measures that have improved the environment, such as the modernization of the economic pact in North America (UMSCA) and the agreement between Mercosur and the European Union.

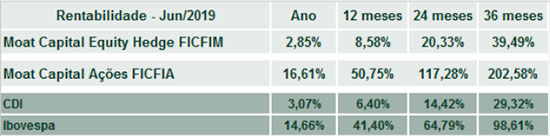

Despite the recent rise in the Brazilian stock market, this movement was in line with that observed in other emerging markets. We understand that the local stock market should have outperformed its peers, but frustration with GDP was priced in by companies. We would like to draw your attention to the sharp contraction in the long local interest rate curve, as a result of the Fed’s change in discourse and the prospect of approval of the pension reform. Such a move has two direct consequences on the stock market.

The first is that companies’ cost of capital remains lower and their future cash flows are more valuable in the present. Remember our last letter, in which we mentioned that the multiple histories will not serve as a reference for a careful analysis in this environment. The second point is that it opens a window for refinancing and extending the debt of companies, reducing their financing costs and, consequently, a relevant increase in profitability.

With this movement in fixed income (falling rates), the stock market became cheaper in relative terms than at the beginning of the year, since the price of assets has not yet fully reflected the fall in the cost of capital (fall interest rates) nor does it incorporate a resumption of growth (which in this last quarter greatly frustrated expectations).

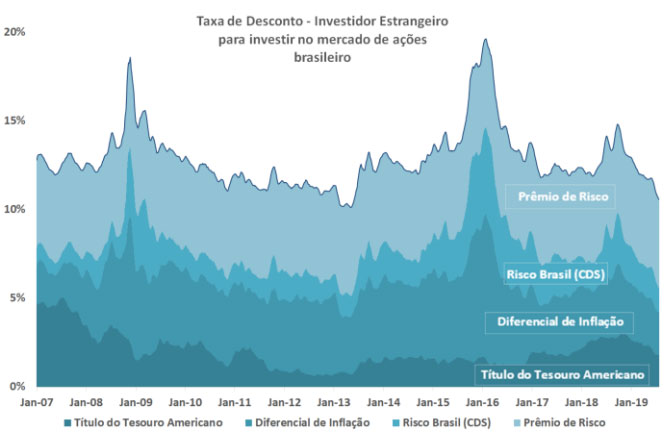

Source: Moat Capital / Graphic Caption: 5-Year US Treasury Bond (5-Year Treasury) / Inflation Differential => Brazil minus USA / CDS => Brazil risk premium (on Treasury) / Risk Premium => opportunity cost (5% per year)

The chart above reflects the structural decline in interest rates globally, as well as, in Brazil, reducing the opportunity cost for risky assets. A foreign investor has as a starting point the treasury income, plus the inflation difference (Brazil – USA), the country risk and the cost of capital.

We maintain our opinion on the direction of long-term asset prices in Brazil unchanged. However, we understand that, in certain short-term windows, prices are disconnected from the long-term fundamentals, reflecting the anguish and setbacks of the trajectory. In moments of greater consensus, such as the current one, such corrections may be more intense, making it impossible to predict or try to quantify them.

Therefore, we remain optimistic about the long-term domestic scenario. In addition to the urgent and necessary fiscal adjustment, there are several microeconomic measures that will further contribute to growth, such as the MP for economic freedom, the MP for Saneamento, the Telecom PL, the consolidation of the labor reform and a possible tax reform among others. All have in common the reduction of the State as the main inducing agent of economic activity.

Most likely, the drop in the State’s share of the economy is already contributing to the slow resumption of activity. When it takes effect, however, the result will be of better quality, since we will have gains in productivity at work, something that has not been observed for several generations.

The profitability obtained in the past does not represent a guarantee of future results. Investments in funds are not guaranteed by the administrator or by any insurance mechanism, or even by the credit guarantee fund. For more information, access the website www.moat.com.br.