Dear shareholders,

The second quarter of 2023 was marked by surprises in both the local and foreign markets. Technology companies were the highlight in the stock market, driven by the expectation that Artificial Intelligence could bring a revolution not only to the sector but to the entire economy.

In Brazil, we observed the consolidation of deflation, which will provide a favorable environment for a cut in interest rates. The government, although always speaking in the opposite direction to the market, was contained by its own inefficiency and by the action of Congress.

In the United States, the economy continued to expand, despite some signs of deceleration, especially in the industry. The job market remains heated even with the interest rate close to 5% per year. Despite some signs of inflation improvement, the Federal Reserve (American central bank), in turn, continues to signal additional monetary tightening.

The improvement in the economic outlook still brings many doubts, the leading indicators point to a slowdown and many attribute the resilience of the American market to post-Covid fiscal incentives and government aid to family balance sheets, which still remains strong, despite the inflationary shock. The slowdown in the economy remains the main risk to be monitored by markets in the United States.

It is also worth highlighting the concentration of the stock market rise in technology companies, which are at the forefront of the Artificial Intelligence revolution. This has not only increased their profit prospects but also their multiples. On the other hand, traditional economy companies, which are more indebted, did not perform as robustly.

In China, we observed a significant change in long-term perspective. The disappointment with the growth of the economy after the post-pandemic reopening raised a series of structural issues, such as the beginning of the process of reducing the Chinese population, already predicted for this year.

Another relevant issue is the country’s high indebtedness, the result of successive stimuli and investments in infrastructure, generating a large bubble in the real estate market, already in the process of deleveraging. In addition, the growing tension between China and Western countries has had significant impacts on markets.

A recurring theme for investors is the migration of investments, previously directed to China, to closer countries or more geopolitically aligned, the “near-shoring”. Mexico, for example, is already beginning to feel the benefits of this theme. The reduction in exports in China and in foreign direct investment have already begun to be noticed.

The weakness of the Chinese economy was preponderant for the significant fall of various commodities, contributing to the scenario of global deflation. In this context, Brazil presents favorable conditions for us to start a cycle of interest rate cuts from August.

The monetary policy of the Federal Reserve will be an important vector in the direction of the markets, as it still generates great uncertainty among the agents. Even though real interest rates remain low in the United States, persistent inflation has affected the value of the dollar in relation to other currencies in the world, contributing to the deflationary environment of emerging economies.

In Brazil, we have observed a very resilient job market, a fall in inflation, especially in fuels and food – where lower-income families commit a larger portion of the consumption basket, and an imminent perspective of a fall in interest rates, giving conditions for a significant improvement in the balance of families and consequent increase in propensity to consumption. Therefore, we believe that potential economic growth may be higher than projected and incorporated into prices.

This quarter, we observed an intense movement of the most indebted companies to inject capital and adjust their balance sheets, accelerating cash generation. Considering the volume of operations and demand, the improvement in the mood of the capital market is notorious.

Lengthening the analysis period, we see that the assets on the stock exchange, even after the good performance this quarter, continue with attractive return rates for 2024. This considering the fall in interest rates implicit in the curve and that we will not have a recession in sight.

In summary, we are at a moment of change in the global cycle. Emerging markets, which suffered for several years with a strong dollar and intense competition for capital by China, begin to witness a reversal of this process. Unless there is a major external shock or a more radical populist turn by our rulers, we believe that a very favorable virtuous cycle begins for emerging markets and, consequently, for Brazil.

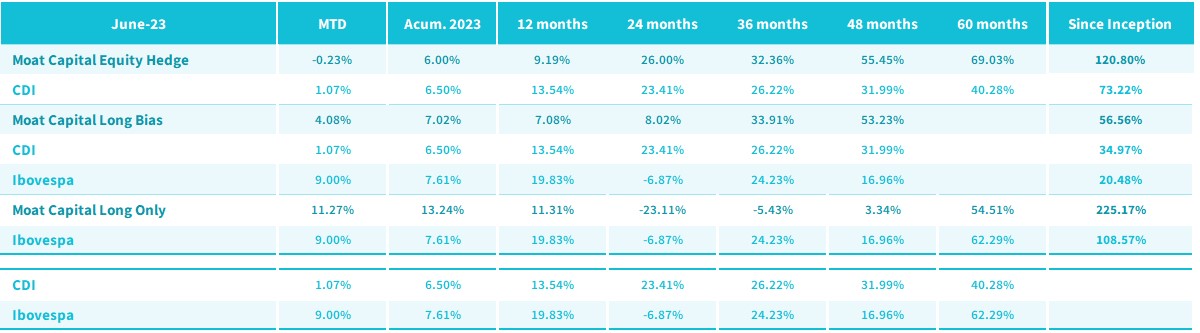

Past performance does not guarantee future results. Investments in funds are not guaranteed by the administrator or by any insurance mechanism or, still, by the credit guarantee fund. For more information visit the website www.moat.com.br. The fund performances are net of fees, Standard fees are 2% management fee and 20% over the benchmark performance fee

Best regards,

Moat Capital