Letter to investors – 4th quarter 2019

Dear shareholders,

Over the past three years, we have been emphasizing (at first, almost alone) the change in cycle that Brazil was starting, after an extremely deep recession. Since 2016, risk assets have appreciated (interest and stock exchange) until we reach the current baseline scenario in which we observe a certain consensus that we are experiencing a recovery, at least cyclical.

Thus, we would like to emphasize in this letter our global vision of the current moment, and how Brazil is inserted in this context.

We ended 2019 with markets quite complacent with the prospective scenario. Much of the associated risks during the year did not materialize, in particular the dreaded global recession and the monetary tightening that began at the end of 2018.

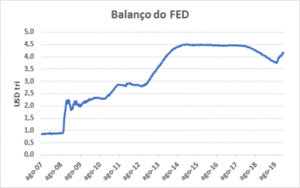

We always look for justifications for price movements. In our opinion, the cause of this significant asset inflation was the change in the position of the Fed (Central Bank) in expanding its balance sheet.

Throughout 2019, world growth slowed down to the point of generating debates about a possible ongoing recession. On the other hand, in order to avoid such a threat, the central banks of the main economies adopted very stimulating postures, with emphasis on the reversal of the Fed’s posture, which in the last quarter started to adopt an expansionist policy. As a result, risky assets, such as the stock market and high-yield credit (securities with greater risk), and defensive assets (example: gold) showed strong appreciation in December. In short, we are seeing significant asset inflation around the world.

The scenario described favors the thesis that we are likely to see growth in emerging markets and a weakening of the dollar against emerging currencies, including the real.

We contextualized this environment so as not to fall into the commonplace of justifying the rise of the Brazilian stock market only by improving its fundamentals. In fact, the outlook for the Brazilian economy and its fiscal dynamics suggest a more robust improvement than econometric models signal. However, some assets and sectors of the Brazilian stock market already incorporate this promising scenario ahead (this does not mean that they are expensive).

Over the past two years, we have seen a relatively adverse scenario for emerging markets. The US fiscal stimulus (decrease in corporate taxes) caused the dollar to appreciate against all currencies, generating consequences in countries with high indebtedness in foreign currency, such as Argentina and Turkey. Fortunately, we spent these two years managing to implement a series of reforms and combating a chronic problem – the fiscal deficit, allowing the country to stand out positively in relation to the outflow of capital from emerging countries.

We are currently seeing a positive growth bias in emerging countries, as well as a possibility of commodity price appreciation. China, which underwent a smoothing of its growth throughout 2019, took fiscal stimulus measures and cut bank reserves that are yet to take effect.

Therefore, we understand that there is an asymmetry of risks in companies exposed to the global cycle, which are an important part of the Brazilian stock market (oil, oil, steel, ore, cellulose and petrochemicals).

Another important and recurring point in discussions among market agents refers to the question of whether we are experiencing the end of the cycle of the American economy and its impact on the stock market – after experiencing the greatest period of expansion in the last 70 years. Currently, unemployment is at historically low levels and investment has been decreasing. It is relatively easy to recognize end-of-cycle characteristics, but very difficult to establish their timing, even more so in an environment where we experience efficiency gains due to technological evolution.

During the period of decline in activity in emerging countries, Brazil consolidated its fiscal framework, allowing for a structural decline in the cost of capital. This enabled a significant migration of capital to the stock market, offsetting the outflow of foreign capital. This movement can be seen through the increase in the participation of equity funds in the total industry – from 4% (December 2016) to 8% (December 2019) according to Anbima – and the entry of individual investors on the stock exchange over the course of of the year.

It is a consensus among market agents that this year we will have GDP growth, with some differentiation in the forecast of its magnitude. Therefore, many assets already incorporate growth in their prices; some more, some less. We are on the edge of those who believe that this year the country will grow more than projected by Focus (Bacen) and at the same time we realize that some assets have little room for disappointment. That is, companies that incorporate high growth and are trading at high multiples at a time of frustration devalue themselves due to lower profit projections and multiple compression.

A counterpoint to this scenario is that all justification for an improvement in world activity comes primarily from monetary expansion. In the long run this may not prove sustainable, causing inflation to erode corporate returns and profits. A point of attention for risky assets that we must monitor.

The question that remains is: if we are going through a period of prosperity, why was the Fed forced to make the move made in the last quarter? We must pay attention to the interruption of this monetary expansion and its consequences on the markets.

Another risk that could generate volatility this year is the American presidential succession. If the Democratic candidate represents a break with the American capitalist model, markets may experience a relevant tail risk. However, we consider it unlikely that a far-left Democratic candidacy will win.

We are still very excited about the stock market, but the composition of our portfolio is relatively different from what we have seen in recent quarters. We still see interesting opportunities, but it seems clear to us that risk asymmetry has diminished. Thus, greater care in the selection of assets will be much more important.

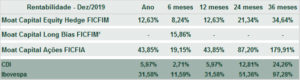

1- Start of the fund: 02/14/2019 / The profitability obtained in the past does not represent a guarantee of future results. Investments in funds are not guaranteed by the administrator or by any insurance mechanism, or even by the credit guarantee fund. For more information, access the website www.moat.com.br

Graciously,

Moat Capital