Dear shareholders,

In the third quarter we witnessed a significant reversal in the trends observed during the previous quarter. The long-term interest rates in the US surged, impacting the global capital market.

Several factors contributed to this dynamic: the resilience of the US economy, the Federal Reserve’s concern over inflation, and OPEC’s decision to cut oil production, increasing the commodity prices. Additionally, countries like China and Saudi Arabia have been consistently reducing their purchases of US bonds amidst a time of high government deficit.

In this context, we foresee two scenarios:

1- American growth remains robust, driven by substantial post-Covid fiscal stimulus, necessitating higher interest rates to mitigate rising inflation.

2- The steep yield curve begins to affect the economy, leading to a slowdown in activity and, consequently, a reduction in long-term rates.

We have a leaning towards the second scenario as various indicators suggest a possible end of the current growth cycle.

Besides the impact of a contractionary monetary policy, another countercyclical aspect is the likely reduction of fiscal stimulus in the US, which should exert additional negative pressure on commodities, considerably aiding in the process of global disinflation. The measures adopted by OPEC, which inflated oil prices, and the stimulus from China, which bolstered metal commodities and pulp, may not be sufficient to counter the effects of the global slowdown.

While the American stock market reflects reduced earnings growth (approximately 10%) and a low premium over fixed income, Brazilian companies tied to the domestic sector are significantly discounted. We believe that the asymmetry for this group is extremely favorable both from a micro perspective and considering the current cycle in the Brazilian economy.

There are several favorable factors to highlight, such as the disinflationary dynamic, an increase in consumer confidence alongside a decline in default rates, and the unemployment rate reaching its lowest level since 2015.

Despite these factors, the complex external environment played a significant role in the local prices dynamic. Although there are domestic conditions for monetary easing, investors have increased the risk premium of the yield curve, suggesting a lower terminal rate.

Another factor that negatively impacted equity market was the speculation regarding government measures to increase revenue, which generated substantial questions regarding their potential impact on companies’ profitability.

The market remains skeptical about the government’s speech and its ability to eliminate the deficit next year. Projections revolve around a 1% deficit, approximately 100 billion BRL. Despite the economic team’s efforts to boost revenue through taxation, there’s significant resistance from Congress towards tax hikes. However, it’s important to monitor the price dynamics of commodities as they are a fundamental vector in the fiscal outcome, especially since a large portion of the government revenue comes from commodities-exporting like Petrobras.

The divergence observed between commodity companies and domestic cyclicals helps explain the funds’ performance in the third quarter, as we continue with most of the risk allocated to the second group. We have decided to maintain this allocation due to the financial relief provided by interest rates, the subsequent follow-ons undertaken by some companies, and the cyclical condition of the economy that should reflect in margin improvements for companies.

In summary, the rise in long-term interest rates in the US dominated market discussions this quarter. However, we believe that Brazil remains quite attractive both in absolute terms and relative to the global context. Even considering the deterioration in the fiscal front, we understand that the price correction was overdone. The current price level reflects a scenario of low growth and a timid monetary easing cycle, factors that seem overstated.

Best Regards,

Moat Capital

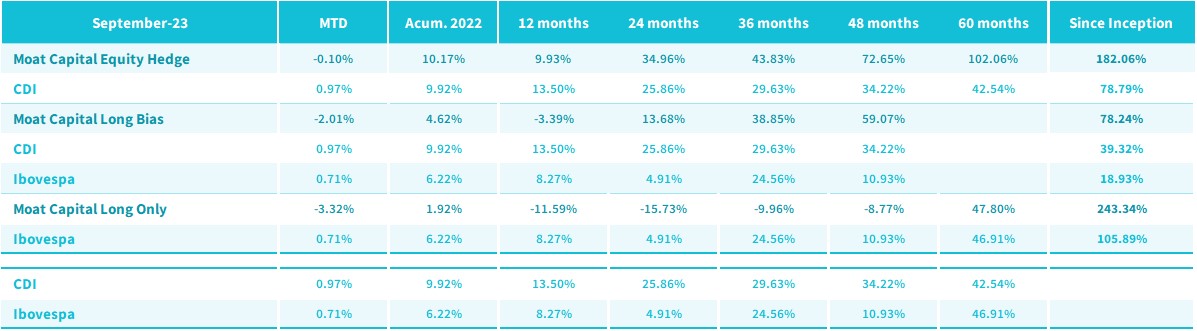

Gross of fees return:

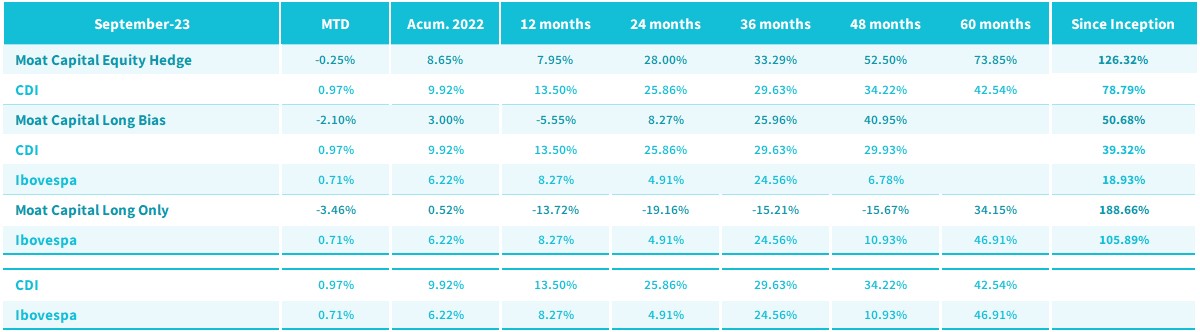

Net of fees return:

Past performance does not guarantee future results. Investments in funds are not guaranteed by the administrator or by any insurance mechanism or, still, by the credit guarantee fund. For more information visit the website www.moat.com.br. The fund performances are net of fees, Standard fees are 2% management fee and 20% over the benchmark performance fee