Why Moat Capital?

Experience

and Seniority Partners with extensive experience in managing third-party resources, each having worked in different areas within the Brazilian and global financial markets.Complementarity

of individual talents. We value the diversity of cultures and thoughts. The partners' background includes professional experiences in the real economy, trading, hedge fund, value investing, venture capital, private equity, among others.Unorthodox

view A high-performing team is based less on individual talents and more on a consensus of complementary opinions. We believe that exhaustive discussion and consensus are fundamental to heritage protection.Manage third-party resources as we manage ours A significant part of the partners' capital is allocated to the funds. In addition, the partners reinvest a significant part of the earnings generated back into the funds.

"Try not to become a man of success, but to become a man of value." Albert Einstein

Principles and Values

Principles

• Manage customers' money as we do with ours;

• Being a high performance business;

• Investment decisions with method, discipline and long-term perspective;

• Attract, train, reward and retain the best talent;

• Maintain the team's adherence to the company's values.Company Management

• Low cost for perpetuity;

• Transparency;

• People based business;

• Pragmatic decisions based on data;

• Long term orientation;

• Simplicity without loss of quality;

• Clear and defined responsibility.People Management

• Environment of excellence;

• We prefer quality over quantity;

• Avoid adverse selection;

• Teamwork where the result is far superior to the sum of individual talents;

• Fair and transparent remuneration is vital for success.

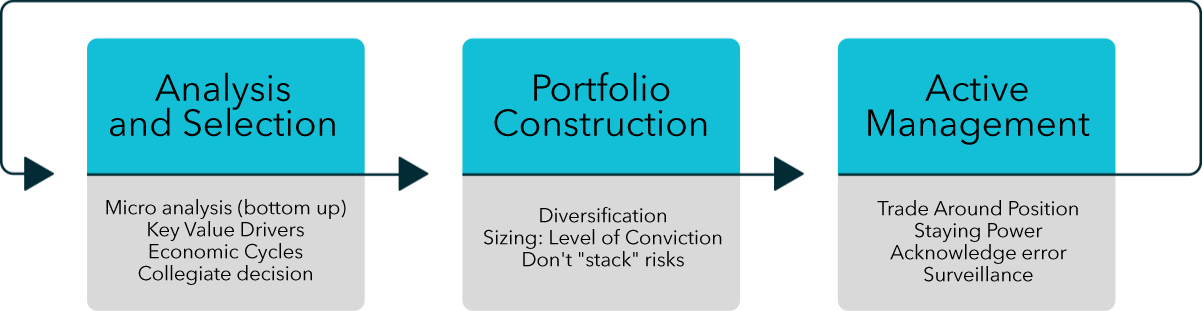

Investment Process