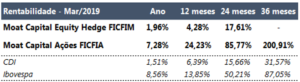

Letter to investors – 1st quarter 2019

Dear shareholders,

Global equity markets appreciated strongly in the first quarter of the year, reversing the losses incurred in the previous quarter. In Brazil, after a January of great euphoria, the market was contaminated by political noise.

In this letter, we would like to highlight the importance of decoupling the short-term noises of the process of change from the long-term political-economic framework. Since the beginning of 2016, society’s desires point to a path of less state intervention and greater individual freedom.

The new government has a window of opportunity to implement important advances towards a more liberal and less interventionist economy. The climax of this change is symbolized by the possible pension reform.

However, this path of fiscal consolidation and improvement of the business environment will not be a straight line, as numerous noises will put the reforms in check and will challenge the base market scenario. In our opinion, we continue towards a resumption of conditions that are more favorable to a structurally lower real interest rate. Thus, we seek to allocate resources based on this long-term process.

For this reason, we would like to emphasize again, as in our last letter, the need to untangle from past assumptions where we lived in an environment of a large and interventionist state, productivity stagnation and low economic growth.

Despite this more likely scenario, frustration over the speed of voting on the pension reform and weaker economic activity than expected for this year, contaminated asset prices, especially those linked to the local economy. However, we do not see concrete elements for a reversal in the long-term scenario transformation process. On the contrary, corporate profits continue to grow at a speed above corporate prices, as shown in the chart below.

The macro and microeconomic agenda is one of the most robust and market-friendly in a generation. We can see a country with approved pension reform, comprehensive tax reform addressed, and a series of privatized state-owned companies. Meanwhile, we’ve watched agents perpetuate mediocre growth.

In our opinion, we still have room for a correction both in the cost of capital and in the growth outlook for the next 3 to 5 years, that is, we can see profits grow and these are valued at multiples higher than what has been seen in the last 25 years.

On the external side, the global economic slowdown, which had been the focus of debate in the markets, was alleviated by recent data on activity in China and the United States. The American Central Bank changed its perception of activity, indicating that it should wait for new data for an increase in interest rates, and some agents even believe in a fall in 2019.

Thus, the world economy returns to that situation called Goldilocks, that is, not so heated to justify an increase in interest rates, but also not so weak that additional stimuli are needed.

In summary, the risks associated with a major global slowdown have been minimized and the local stock market continues to have better long-term prospects despite the slower short-term speed.

The profitability obtained in the past does not represent a guarantee of future results. Investments in funds are not guaranteed by the administrator or by any insurance mechanism, or even by the credit guarantee fund. For more information, access the website www.moat.com.br

We would like to take this opportunity and inform you of the launch of the long bias strategy (Moat Capital Long Bias FICFIM), a fund that seeks to capture returns on the stock market, which may oscillate directional exposure, combining uncorrelated strategies.

Graciously,

Moat Capital